Build with

At FIN-ED, we empower individuals by providing essential financial knowledge and skills, enabling them to confidently navigate and succeed in tomorrow’s economy.

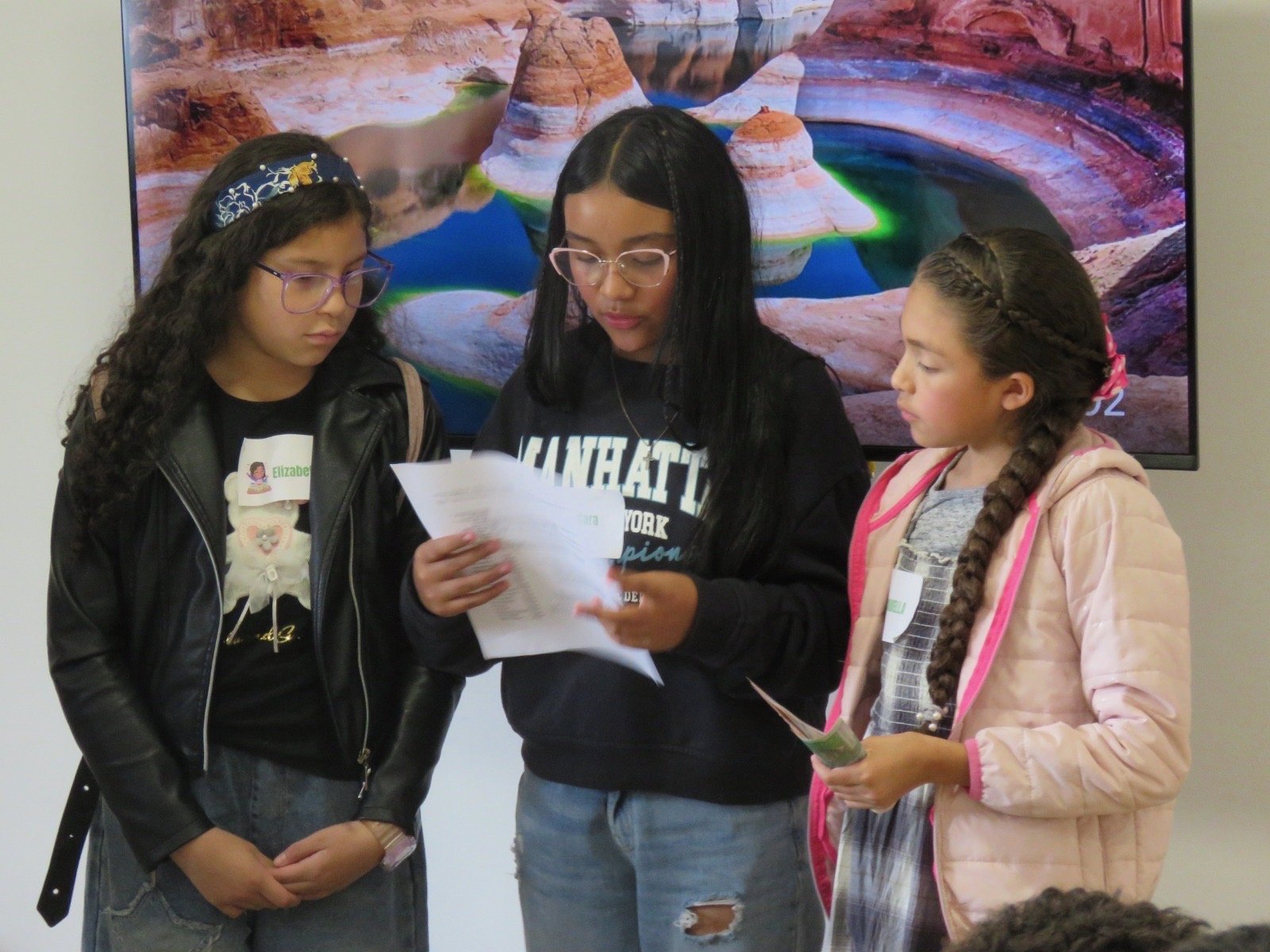

Join our engaging seminar for any age, where you’ll learn the essentials of financial literacy. Participants will discover the value of money, differentiate between needs and wants, and grasp basic budgeting skills. Through fun activities and games, will understand the importance of saving and making informed spending decisions. This interactive experience empowers people to develop responsible money habits that will benefit them throughout their lives. Sign up today!

Financial Education Programs

Why financial literacy matters.